Mar

What’s On Trend For 2019? Meat Snacks

What’s On Trend For 2019? Meat Snacks.

January 9, 2019

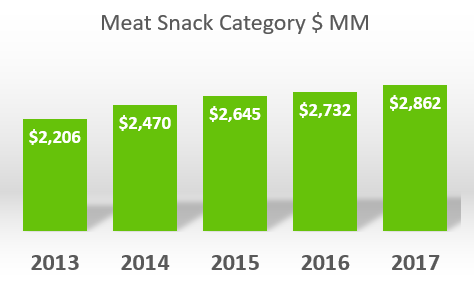

Meat Snacks continue their explosive growth, averaging 7+% growth per year for the past 5 years, and is projected to hit $3 Billion in 2018. Meat Snack growth is in the top 5% of all food category growth in retail stores. Meat Snacks remain the top seller in c-store alternative snacks, with sales racking up more than double that of health, energy and protein bars. In the 52 weeks ending on September 22nd, 2018 meat snacks sales in convenience stores totaled over $1.5 billion, a 3.6% increase from the same period in 2017, according to Nielsen.

Meat Snacks are up 30% in sales growth over the last 5 years.

Consumer lifestyle changes are one reason for Meat Snack growth. High protein, paleo, keto and mediterranean diets are popular. There are 35 million households with at least one person on a diet. Claims fueling the growth are all natural preservatives, and clean label ingredients.

Meat Snacks are growing +1.1% in Northwest convenience store market this year. Harbor Wholesale Meat Snacks growth is +6.0%, six times the growth of NW

Convenience. Most notably, consumers are switching to larger sized packages. For example, standard (3-5 oz.) size jerky sales declined ($783,555) in the Northwest, while large and extra-large (>5.0 oz.) jerky/sticks grew +$1.2 million! Large and extra-large sizes now represent 28% of jerky sales, which is double from a few years ago. Popular large size products on the Harbor schematic include Oberto 9 oz. jerky and Old Trapper 10 oz. jerky. These items are a great way to increase basket ring in the store.

American households spend an average of $25.81 per year on meat snacks. Their pre-trip spend on sticks and jerky at $7.42 is also twice as much as it is on staples like potato chips, which are at $3.61, and popcorn, which totals $4.01, according to Nielsen. In terms of age groups, baby boomers are the biggest buyers, spending $28.48 per year, making them 10% more likely to buy meat snacks than the average shopper.

Meat Sticks grew +0.7% in the Northwest this year. Oberto Cocktail Pep and Smok-A-Roni are the top two selling stick items which can be merchandised either in a caddy or pegged, and have the highest dollar growth within Harbor Wholesale Meat Stick products. Slim Jim Monster 1.94 oz. items are highly ranked items that are growing in the Northwest and in the Harbor portfolio.

Bulk products account for 22% of sales dollars.

Bulk, or unwrapped jerky represents 22% of total meat snack sales. The Tillamook bulk program is the most popular modular floor display.

The Oberto Cocktail Pep acrylic counter top display is the highest volume at Harbor.